The business activity of a yacht marina, examined from a purely financial point of view, develops and takes concrete form in a continuous and complex system of cash-in and cash-out, marked, on the one hand, by receipts from mooring and services provided to yachtsmen and, on the other, by ordinary management costs as well as those of plant maintenance, investment, hiring, repayment, and remuneration of loans.

To carry out its activity, the Marina needs financial means to be allocated to cover its needs.

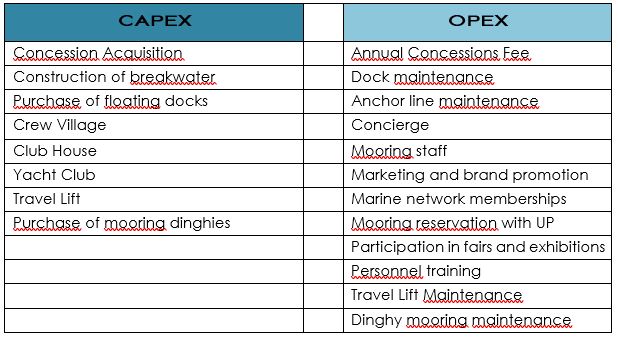

The Board of Directors and, on their behalf, the Chief Financial Officer of the Marina shall at all times monitor the performance and forecasts for two key expense items: CAPEX (Capital Expenditure) and OPEX (Operating Expense)

Capital expenditures (CapEx) are the financial resources that a Marina uses to purchase and implement so-called fixed assets such as docks, landside facilities, vehicles, travel lifts, dinghies for mooring, etc. Generally speaking, CAPEX, which is characterized by multi-annual usefulness, refers to all the actions taken to create the tangible and intangible “platforms” necessary for the provision of services that will generate revenues. CAPEX can be found in the balance sheet as a “stock” value, in the cash flow statement as cash flow from investments, and in the income statement as depreciation, which measures the obsolescence of the asset until its value reaches zero.

Investing in CAPEX is one of the key tools for increasing shareholder value

Capital expenditure is contrasted with operating expenditure (OPEX for short) which, on the other hand, concerns the management and maintenance of an asset. Back to the previous example, if the purchase of a travel lift falls under capital expenditure, then the costs of maintaining it, such as fuel or overhaul, count as operating expenses.

Operating expenses refer to costs incurred in maintaining the Marina and carrying out CAPEX-generated activities. Ongoing expenses for berth management and front office administration are considered OPEX. Thus, OPEX is expenses that are necessary to maintain the Marina’s capital assets.

Below is the sample breakdown between Capex and Opex for a yachting marina:

To finance CAPEX and OPEX, the Marina can, first of all, count on the resources generated internally as a result of management – so-called self-financing – and the excess requirement will demand external coverage through recourse to shareholders, who confer risk capital, or to third parties, who confer capital with a debt obligation.

To approach the capital market, the economic realities operating in the Marina world, defined as capital intensive, will have to equip themselves, first of all, with good net equity characterized, principally, by the sum of the share capital and the reserves of undistributed profits. In the following diagram, we attempt to answer the question which is often asked during management analysis.

WHAT IS THE CORRECT PROPORTION OF EQUITY TO LIABILITIES IN THE BALANCE SHEET?

We will revisit the same topic to elaborate on CAPEX and OPEX following the transformation to a Superyacht Marina.

If you liked this article, please share it!